A quick review of long-term trends indicates that the tourism and hospitality industry in India has firmly played a pivotal role in its economic growth. In the years to come the sector is expected to continue being an important cog-in-the-wheel. Hospitality and hotels will continue to be important drivers of India’s engine of economic development. It is important to note that the Indian hospitality industry has long relied on traditional asset classes such as hotels, resorts, and serviced apartments. In recent years, a growing array of alternative asset classes have emerged, driven by evolving traveller preferences, technological innovation, and shifting capital allocation. This article provides a birds eye view on these alternatives, exploring their characteristics, risk/return profiles, market dynamics, and considerations for investors and operators.

Asset Light Market Structure

I has undertaken a detailed analysis of the asset light business model, its market structure and undertaken market opportunity evaluation to understand the various trends prevailing in the asset light hotel development models. For the purpose of evaluation of the various market structures and access the right market opportunity, I have undertake a critical evaluation of each of the defined development model and undertaken a strategic assessment. The various development models being evaluated as a part of the assignment include:

Hotel Management Agreements

Brand Franchise Agreements

Third Party Management Models

Soft

Brand Associations

Market Aggregator Model

Owner Operator (Leased Asset) Model

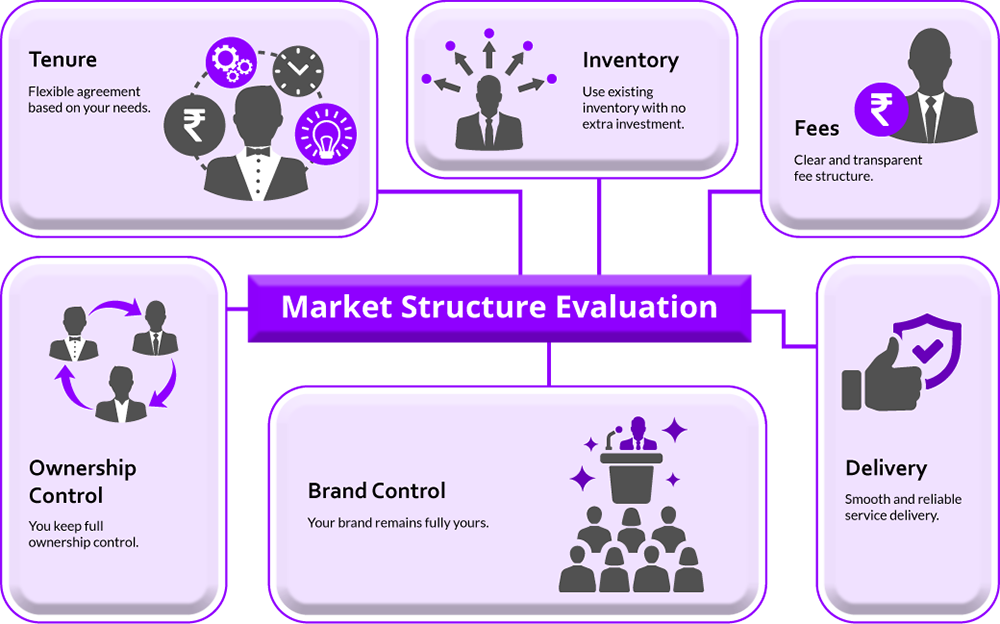

Evaluation of Market Structure

The market structure prevailing in the six hotel development models being adopted have been evaluated based on the following criterions.

Market Structure

| Development Model | Relationship Structure | Tenure* | Inventory | Product Positioning | Fee Potential | Fee Types | Brand Control | Ownership Control |

|---|---|---|---|---|---|---|---|---|

| Hotel Management Agreements | Capital investment by asset owners. Brand manages operations, revenues, marketing, and distribution. | 15 – 25 Years | 100+ | Luxury, Upscale, Mid Market, Budget, Economy | 6.0% – 8.0% of Gross Hotel Revenues | Technical Services Fee, Gross Revenue Linked Base Fees, GOP Linked Incentive Fees, S&M Fees, Distribution Commission | Full | None |

| Brand Franchise Agreements | Asset owners invest and operate. Brand supports marketing, distribution, and operating standards. | 10 – 15 Years | 100+ | Mid Market, Budget, Economy | 3.0% – 4.0% of Gross Hotel Revenues | One-Time Signing Fee, Rooms Revenue Linked Royalty Fees, Delivery Linked S&M and Distribution Fees | Low | High |

| Third Party Management Models | Asset owners invest while operations are managed by an independent third-party operator. | 5 – 10 Years | Flexible | Mid Market, Budget, Economy | 3.0% – 4.0% of Gross Hotel Revenues | Gross Revenue Linked Base Fees, GOP Linked Incentive Fees, Delivery Linked S&M Fees | Moderate | Moderate |

| Soft Brand Associations | Asset owners operate under an independent brand with sales, RFP and distribution support from soft brand. | 3 – 5 Years | Flexible | Luxury, Upscale | Annual Membership Fees + Sales Commissions | One-Time Signing Fee, Annual Membership Fees, Delivery Linked S&M and Distribution Fees | Low | High |

| Market Aggregator Model | Aggregators provide sales and reservations support. Revenue earned via dynamic pricing margins. | 1 – 3 Years | Flexible | Budget, Economy | One-Time Membership Fees + Margin on Sales | One-Time Signing Fee, Annual Renewal Fees, Commission on Sales and Margin via Dynamic Pricing | None | Full |

| Owner Operator Model | Brand owns asset and manages all revenues, costs, operations, marketing and distribution. | Perpetual | Flexible | Luxury, Upscale, Mid Market, Budget, Economy | Not Applicable | None | Full | Full |

*Subject to contract confirmation.

| Development Model | Key Deliverables and Responsibilities of the Brand | ||||||

|---|---|---|---|---|---|---|---|

| Revenues | Cost Mgmt | Profitability | Operations | Sales | Distribution | Marketing | |

| Hotel Management Agreements | Full | Full | Full | Full | Full | Full | Full |

| Brand Franchise Agreements | Partial. Limited to Website, GDS and National & International RFP revenues | None | None | Partial. Limited to providing Operating Best Practices to the hotel | Partial. Limited to national and international RFPs | Full | Partial. Regional & International marketing support at brand level |

| Third Party Management Models | Partial. Unit & national sales by third party; Website, GDS & RFPs by brand | Full | Partial. Owner controls finance & purchase functions | Full | Partial. Country sales via RSO; RFP & GDS sales by brand | None | Unit-level initiatives. Group-level marketing by brand |

| Development Model | Key Deliverables of the Brand | ||||||

|---|---|---|---|---|---|---|---|

| Revenues | Cost Mgmt | Profitability | Operations | Sales | Distribution | Marketing | |

| Soft Brand Associations | Limited to revenue generation through the brand website and providing distribution support | None | None | None | Limited to RFP support for key national and global accounts | Full | Limited to group-level marketing initiatives at brand level in key national and international feeder markets |

| Market Aggregator Model | Limited to revenue generation through the brand website and providing distribution support | None | None | None | None | Limited to brand website | Limited to group-level marketing initiatives at brand level in key national feeder markets |

| Owner Operator Model | Full | Full | Full | Full | Full | Full | Full |

Conclusion

If you have any questions or queries about alternative asset classes and other trends in the hospitality industry please connect with us. Our experts will be glad to help you with your needs.