For long I have discussed the manner in which rapid changes in end-user preferences and owner investment structures have impacted the hotel industry, and how these transformations are acting as able catalysts in a world where geography is rapidly becoming history.

The global hospitality industry has become characterized by frequent changing-hands of hotel assets. Recent years have seen the emergence of new markets, changes in hotel ownership patterns, and new management and ownership structures. Two important developments have come into being: firstly, an increased focus on an ‘RoI’ strategy; and secondly, the complexity of deal structuring for ‘layered’ ownerships and operations. International real estate companies have, for many years now, adopted a strategy of quickly offloading owned assets and concentrating on the core business of managing services and consumer aspirations. In the medium term, the Indian market is expected to re-align its real estate investment and portfolio allocations in line with real estate developments around the world.

An Overview

| Positioning | Destination Profile | Ownership | Investment Returns | Liquidity | Potential Markets | |

|---|---|---|---|---|---|---|

| Timeshare | Mid Market - Upscale | Leisure | Contractual defined right of occupation and usage | Benefit of usage and exchange | None | Popular Leisure Travel Circuits and getaway destinations |

| Vacation Ownership | Upscale - Luxury | Leisure | Contractual defined right of occupation and usage | Benefit of usage and exchange with “branded” service | None | Popular Leisure Destinations |

| Fractional Ownership | Upscale - Luxury | Leisure/City | Ownership of shares of units | Benefit of usage & exchange with “branded” service + Yields + Capital Gains | None - High | Leisure destinations + Tier I Cities |

| Private Residence Clubs | Upscale - Luxury | Leisure/City | Ownership of units in part or as whole | Benefit of usage and exchange with “branded” service + Capital Gains | Low | Metros |

| Serviced Apartments | Limited Service - Luxury | Leisure/City | Ownership of units in part or as whole | Income from Operations + Capital Gains | High | Leisure and Commercial Markets |

| Condo Hotels | Upscale - Luxury | Leisure/City | Ownership of single letting units | Benefit of usage & exchange with “branded” service + Yields + Capital Gains | High | Popular Leisure Destinations + Tier I Cities |

Comparative Analysis

| The Highs | The Lows | |

|---|---|---|

| Timeshare | Lifestyle product, available in pre-sold blocks, low entry cost, benefits of exchange, Member Benefits and Exclusivity. | No ownership, No operational control, High depreciation, No liquidity |

| Vacation Ownership | Lifestyle product, branded service, exclusivity, membership and loyalty benefits, pre-sold blocks, cost benefits | No ownership, No operational control, High depreciation, No liquidity |

| Fractional Ownership | Part ownership, upscale lifestyle, branded service, exclusivity, membership and loyalty benefits | Limited investment benefits, high cost of entry, limited flexibility |

| Private Residence Clubs | Part ownership, upscale lifestyle, branded service, exclusivity, membership and loyalty benefits | Cost of entry and upkeep |

| Serviced Apartments | Income from operations, yielding asset class and capital appreciation | It's an investment not a usable product!! |

| Condo Hotels | All of the Above!! | It's Expensive!!! |

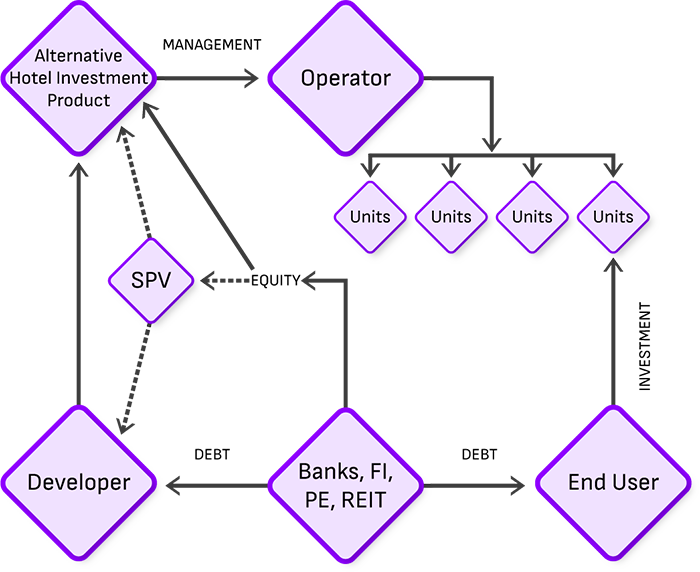

The Structure

Conclusion

While it is true that there are various opportunities in the alternate hospitality space that an organization can avail of, measurement of tangible benefits is critical. How, and to what extent, an organization will benefit by embarking on this journey remains to be seen. If you have any questions or queries about alternative asset classes and other trends in the hospitality industry please connect with us. Our experts will be glad to help you with your needs.